What Are Insurance Riders?

A rider — also known as an insurance endorsement — is an optional provision that can alter the coverage of a standard insurance policy. Riders can be used to add benefits to a policy or to amend its terms, which allows for customization without having to cancel the policy or purchase a new one.

Riders are available for life, homeowners, long term disability, and auto insurance policies, among others.

What You Should Know

- Riders can help policyholders customize insurance products to meet their particular coverage needs by addressing issues or items that are not in the original policy contract.

- A rider is not a standalone product, but rather a provision to an existing insurance policy.

- The availability of riders depends on the insurance company and the state in which the policy is sold.

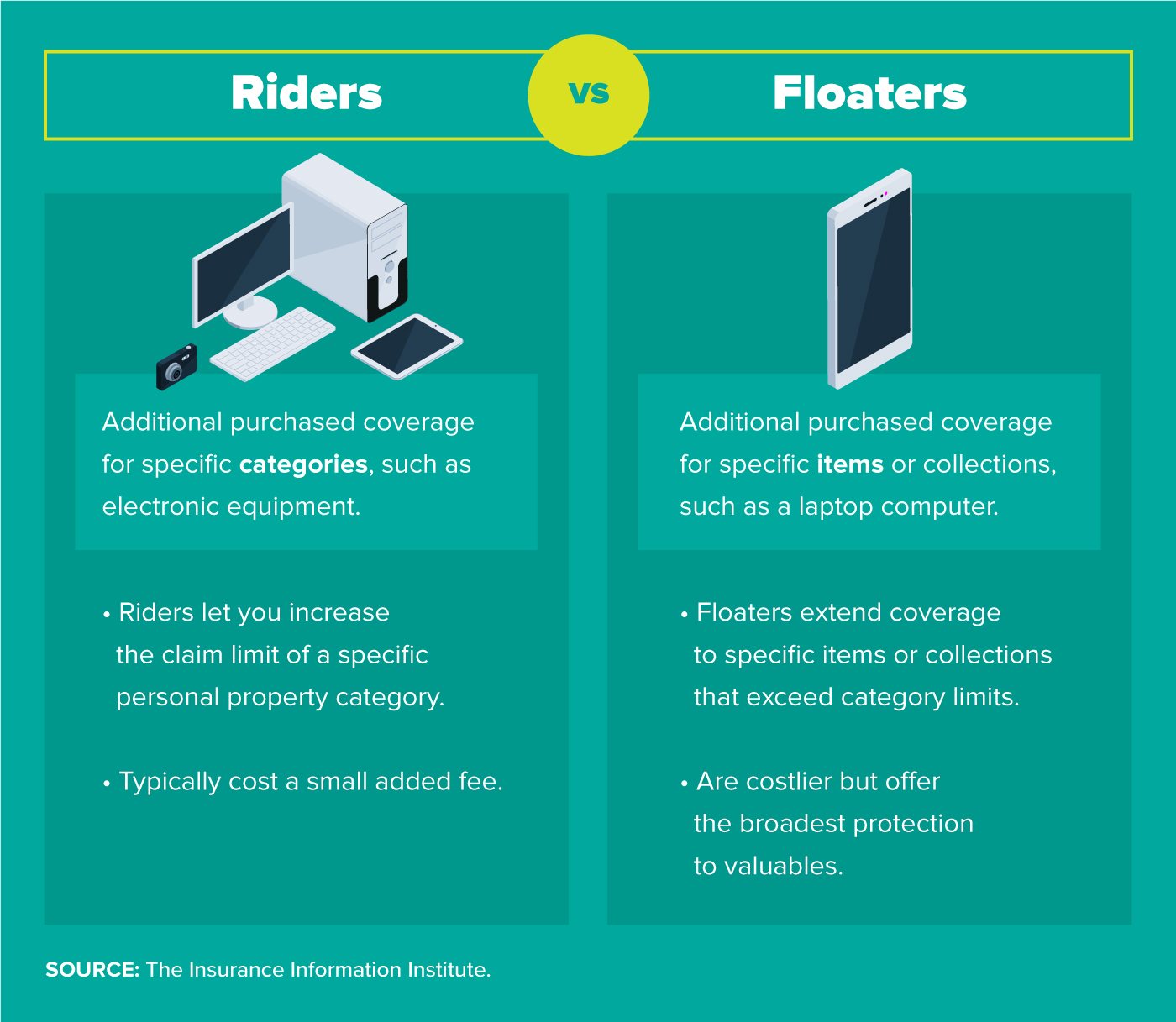

- Riders add optional coverage to a policy. Floaters, while similar, do not extend coverage but increase it on certain items.

- Some riders, like life insurance term conversion, can be included on your policy at no cost, while others require paying an additional premium.

Common Riders

When you purchase an insurance policy, riders allow you to add benefits to your policy to fit evolving circumstances and priorities.

For example, if you’re a new parent and the sole breadwinner, adding a family income benefit rider to your life insurance policy can provide your spouse and children with money equivalent to your monthly income in the event of your death.

Or if you’re looking to reduce the hassle of car breakdowns, adding a roadside assistance and towing rider to your auto insurance can allow you to summon service in a single phone call.

Since most riders come at a cost, the decision to add them to your policy should depend on your budget and the value to you of the additional coverage they provide. In many cases, riders can be worth the added expense.

Life Insurance

Adding a rider (or riders) to your life insurance can increase the security the policy provides, by covering you for fresh needs or against unexpected events that aren’t currently included.

They’re available for term, whole, or universal life insurance policies.

Here’s a list of riders for life insurance policies, beginning with some of those that are most often chosen.

Accidental Death and Dismemberment (ADD). The most common death benefit rider. It pays out an additional amount, on top of the regular death benefit, if the insured dies in an accident or loses a body part or bodily function. This rider could especially suit those who have high-risk jobs or engage in risky hobbies such as skydiving or scuba diving.

Living Benefit. Acts as a financial cushion while you’re still alive. Part or all of the death benefit is paid in the event of unexpected circumstances such as illness or an inability to independently take care of yourself.

Terminal Illness. Considered a living benefit rider that can be used while the insured is still living and is diagnosed with a terminal illness. The terms of this rider vary by state law.

Critical Illness. Provides financial protection while you’re still alive, to cover the cost of treatment for cancer, stroke, heart attack, kidney failure, and any other illness that limits your life expectancy and carries high medical bills. Covered illnesses are specified in the terms of the rider and vary by company.

Chronic Illness. Covers you when you’re unable to perform some of the basic activities of daily living, or you suffer severe cognitive impairment. Activities of daily living include bathing, dressing, eating, transferring, toileting, or continence.

Family Income. Pays out the death benefit over a period of time rather than in a lump sum if the main breadwinner dies. This is a good option if the policy owner is concerned about the beneficiary not being prudent when they receive the lump-sum death benefit.

Children’s Term. Includes coverage for children in a guardian’s policy. If the covered child dies within the term of the policy, the guardian receives a death benefit. When the child reaches a certain age, typically between 21 and 25, the rider allows the child benefit to be converted to a permanent life policy without requiring a health exam or questionnaire. The CTR can usually be converted for up to five times the amount of the rider, so a $25,000 CTR can be converted to a permanent life policy worth $125,000.

Spousal Insurance. Adds a death benefit for your spouse’s income if that contributes to the household income and they die. It may not cover the entire income, though, and your spouse may need to additionally purchase their own policy.

Return Of Premium (ROP). Refunds the premiums you’ve paid throughout the life of the policy if you outlive its term. Typically doubles or triples premiums, which may make it unaffordable for some.

Guaranteed Insurability. This rider allows you to purchase additional life insurance at specific future dates without having to answer any health questions or take an exam, even if your health changes. The dates may be age-related, such as when you turn 25 or 30 or related to a life event such as marriage, buying a first home, or having a baby.

Waiver of Premium. Waives future premium payments if the policyholder becomes seriously ill, injured, or disabled. There is usually a waiting period of 3 to 6 months before premiums may be waived.

Term Conversion. Allows you to convert your term life policy into a permanent life policy within a specified period. These are what’s known as benefit structure riders, which modify the terms of the policy itself rather than adding to it.

Homeowners Insurance

Riders on homeowners insurance policies expand your coverage limits, increase coverage for certain high-value items, and extend protection to cover against some unexpected perils of owning a home.

Homeowners coverage comes in two major types: HO-3 policies, commonly known as “special form,” and HO-5 policies, also known as “comprehensive form.”

HO-3 policies typically cover you against 16 named perils or risks, such as damage from fire, water, or mold. With such policies, which are the least expensive and thus the most common, riders can serve to add coverage for perils that are not on the list, such as water backing up from drains into the home.

HO-5 policies on the other hand operate on an open-perils basis, meaning that the list of covered perils isn’t specified. Instead, all damages to the home or property are included as long as the events or perils that caused them are not listed as exclusions. Here, as with HO-# policies, riders can serve to increase the level of coverage for specific categories of possessions, such as jewelry or artwork, or to add coverage for a business operated from home or to upgrade the home to current codes during rebuilding.

Here are some of the most common homeowner insurance riders available:

Scheduled Personal Property Coverage. Offers expanded coverage for certain high-value items such as antiques, jewelry, and furs. The coverage limits for your scheduled valuable property can usually be increased up to each item’s appraised value.

Water Backup Coverage. A standard HO-3 policy typically doesn’t cover water damage caused by a backed-up drain or sump pump. This rider provides coverage for such events. (Note, though, that the rider doesn’t cover damage from water that floods into the home from heavy rains, overflowed rivers, or ocean storm surges. Those perils require a separate flood insurance policy.)

Building Code Coverage. Relevant to those with older homes that may not be up to date with current building codes. This endorsement covers the additional cost of updating your home’s building code after a covered claim.

Business Property Coverage. If you’re operating a home-based business, a standard HO-3 policy won’t cover business property stored in your home. This endorsement protects those items. To get the most thorough coverage, however, insurance professional Duncan France recommends purchasing this as a separate commercial policy.

Identity Theft Restoration Coverage. Provides coverage in the event your identity is stolen, although it may not be as comprehensive as you want or need.

Auto Insurance

Strictly speaking, auto insurance has no riders. Instead, policyholders can choose to purchase “optional coverage.” The difference is mostly semantics. Much like riders, optional coverage provides added protection at an extra cost. Keep in mind, however, that standard auto coverage varies by company. Make sure you know what is and isn’t already included under your auto policy before you purchase additional protection you may not need.

Here are some optional coverages to add to your policy:

Rental Car Reimbursement. Covers most of the cost of a rental car while your own vehicle is being repaired due to a covered accident. (In addition, as a rule, your car insurance will cover you when renting a car for other reasons, although you will be subject as usual to paying the deductible in case of any claim.)

Roadside Assistance. Offers extended protection like flat tire replacement, lost key recovery, battery jump start, and car towing. Unlike third-party services, these usually don’t have a cap on the number of service calls you can make.

Long-Term Disability Insurance

This policy type protects your income should you become disabled due to an accident. Although more than half or so of employers offer disability insurance, frequently for free, coverage from work only runs for six months or so at most. Coverage for permanent disability requires a long-term disability policy, which you usually have to buy yourself.

Here are some riders that enhance LTD policies or provide certain relief from paying premiums:

Guaranteed Renewable. Assures your policy will not be canceled as long as you are paying the premiums. This rider comes standard with most long term disability policies or can be added at no extra cost.

Waiver of Premium. Waives premium payments while you’re waiting on a claim, until you’re able to resume the payments.

Automatic Increase Benefit. Increases your monthly benefit to match pay increases, without having to undergo additional underwriting.

Presumptive Total Disability. Pays out the full benefit if you become physically disabled — such as losing sight, hearing, speech, or two limbs. You’re generally paid from the first day of such a disability, regardless of any elimination period between the onset of your disability and the beginning of benefits.

Family Care Benefit. This will pay out your benefit in full if you need to take time off work to care for a loved one.

Survivor Benefit or Death Benefit. If you die while on a disability claim, your beneficiary will receive a payout. This benefit shouldn’t be used as a replacement for life insurance.

Good Health Benefit. Reduces the elimination period by two days each consecutive year you go without a claim.

Occupational Rehabilitation. Pays out for vocational rehabilitation after disability to help you return to work.

Own Occupation. Modifies the qualifications of a claim to fit your specific occupation.

Non-cancellable. Guarantees your premium payments will not go up by limiting the insurance company from increasing your premium.

Partial or Residual Disability Benefit. Pays out if you experience loss of work because of a decrease in hours or productivity, even if you’re still employed.

Future Purchase Option. Lets you increase your coverage in the future without presenting any medical evidence, therefore waiving the underwriting process.

Student Loan. If you’re out on a claim, this rider will cover your loan payments. Useful for those who start off their careers with high incomes and student debt, such as attorneys and doctors.

Retirement Protection. If you’re disabled while budgeting to protect your retirement, this rider will keep contributing to your 401(k) or individual retirement account.

Social Security Offset. By applying for this rider, you agree to apply for Social Security disability insurance. In the event of disability, your insurer would subtract the SSDI from their benefit amount.

Cost-of-living Adjustment (COLA). Increases your monthly benefit using the Consumer Price Index only while you’re collecting disability insurance. This can be a costly add-on.

Catastrophic Disability Benefit. Pays out an additional benefit in the event of a catastrophic disability that keeps you from performing two activities of daily living, such as eating and bathing.

Unemployment Premium Suspension. With this rider, you won’t stop owning the policy if you’re unemployed, and you won’t have to keep paying premiums during this period. There is one caveat: if you become disabled during this time, the insurance won’t cover your claim.

Return of Premium. Returns a percentage of premiums paid if you cancel your policy, albeit at a steep price.

Are Riders Worth the Expense?

According to insurance expert Chris Abrams, adding riders to your insurance policy is a gamble. “Your risk is paying more up front, but you will be relieved if you ever need it. If you add a rider and never use it, then you paid for something you didn’t need. Since we don’t know what the future holds, insurance — with or without riders — provides peace of mind.”

Another risk is that the cost of a rider may rise over time. As with premiums for the policy itself, riders and optional coverages may fluctuate in price from year to year. The changes may be affected by the frequency of claims filed in your area the previous year.

How To Add Riders To Your Policy

According to the National Association of Insurance Commissioners, you can add riders to your insurance policy at any point in time, whether that be upon purchasing the policy, halfway through the current policy term, or even as your policy renewal period is approaching.

When considering insurance riders, the objective is not to find the most coverage, but the appropriate coverage for you — which may change and evolve over time. Reaching out to your insurance agent at least twice a year is a good rule of thumb to keep your policies up to date with your evolving priorities. “If you see a pressing need, definitely reach out to your agent directly and ask for their advice, and if you can, address the concern immediately” explains France.

Check out the full article here: https://money.com/what-are-insurance-riders/

This material contains only general descriptions and is not a solicitation to sell any insurance product or security, nor is it intended as any financial or tax advice. For information about specific insurance needs or situations, contact your insurance agent. This article is intended to assist in educating you about insurance generally and not to provide personal service. They may not take into account your personal characteristics such as budget, assets, risk tolerance, family situation or activities which may affect the type of insurance that would be right for you. In addition, state insurance laws and insurance underwriting rules may affect available coverage and its costs. Guarantees are based on the claims paying ability of the issuing company. If you need more information or would like personal advice you should consult an insurance professional. You may also visit your state’s insurance department for more information.