The Looming Threat of a Government Shutdown and Its Financial Implications

The federal government stands on the brink of a shutdown, with a critical deadline approaching. If Congress can't reach an agreement to fund agencies by the end of this week, the government's funding will expire on Saturday, September 30, 2023. Should a funding plan fail to materialize, a government shutdown will trigger at precisely 12:01 a.m. on Sunday, October 1, 2023.

What Happens During Government Shutdown

So, what unfolds during a government shutdown? It amounts to a suspension of many government operations until Congress acts to restore funding. Currently, the duration of a potential shutdown remains uncertain, hinging on how swiftly Congress can pass funding bills. The ramifications would be far-reaching, affecting the entire nation. Nearly 2 million civilian federal workers, with 15% based in the Washington area, and an additional 2 million military workers would grapple with delayed paychecks.

Reflecting on the past, the most recent and prolonged government shutdown occurred in 2018-2019, lasting a staggering 34 days. Many federal workers found themselves seeking external assistance from sources like food banks, churches, and volunteer organizations.

Why Do Government Shutdowns Even Happen

Government shutdowns arise when Congress fails to pass funding legislation, signed into law by the president. Ideally, lawmakers should pass 12 distinct spending bills to fund government agencies, but the process is notoriously time-consuming. Consequently, they often resort to temporary extensions, known as continuing resolutions or CRs, to keep the government operational.

What Happens to the Stock Market

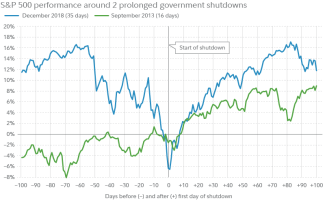

Markets generally exhibit a distaste for U.S. government shutdowns due to the uncertainty they cast upon the economy, companies, and investors. During such periods of uncertainty, the median S&P 500 typically experiences a decline, with the largest drop of 19.8% recorded during the most recent government shutdown from December 21, 2018, to January 23, 2019.

However, there's a silver lining amid the market turmoil. Following the expected decline in the median S&P 500, markets often rebound once normalcy is restored. In the 12 months following a government shutdown lasting 10 days or more, the S&P 500 has seen a median gain of 18.9%, as reported by RBC's research.

How Can You Prepare

Protecting your finances during a potential U.S. default or shutdown can be challenging, given the external factors beyond your control. Nonetheless, there are proactive steps you can take:

- Consider postponing major purchases during the shutdown period. High levels of uncertainty and volatility can lead to fluctuating currency values and interest rates. Waiting for more stable economic conditions may be prudent.

- Keep a vigilant eye on your investments and stay informed about market developments. Different industries may experience varying levels of volatility, so diversifying your portfolio and making timely investment decisions can help safeguard your assets.

- Reassess your budget and make necessary adjustments to your spending habits. With the duration of the government shutdown still uncertain, it's wise to prepare for potential impacts on the economy and financial markets.

As the critical deadline approaches, the uncertainty surrounding the duration of a potential shutdown hangs in the balance, dependent on Congress's ability to reach an agreement. The stock market's response to government shutdowns highlights the aversion of markets to uncertainty, with the median S&P 500 typically experiencing declines. However, history has shown that once stability is restored, markets tend to rebound, offering a silver lining to investors. Vigilance and adaptability in managing personal finances at this time become paramount in navigating the potentially turbulent waters ahead of us.